|

| weblog/wEssays archives | home | |

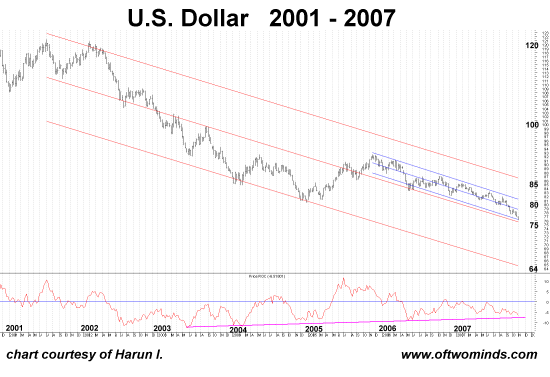

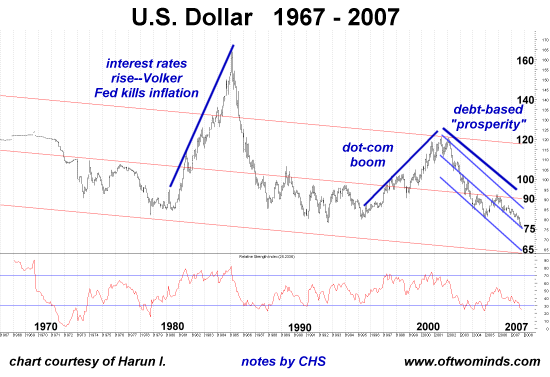

Empire of Debt II: The Dollar (November 6, 2007) Frequent contributor Harun I. responded to my inquiry about the dollar's downward path with these charts and comments: The dollar is in a do or die position. (emphasis added--CHS) A strong down bar this month will probably lead to a loss of confidence and therefore panic. Any large, disorderly breaks may force the Fed to raise rates or the market will do it for them. The technical structure as well as the COT (commitment of traders) data is strengthening suggesting a reaction but that could change on a dime. Early longs would be forced to liquidate, exacerbating the down move. The dollar may bounce at the 2 standard error channel boundary but we are in uncharted territory which may lead to some pretty irrational behavior.Harun sent two charts plotted with channels. One displays the years 2001-2007, while the second one is long-term, covering the 40 year period 1967 - 2007.

Here are Harun's comments on the first chart (above): Where the dollar may go and how it may affect us largely depends on the time frame. This weekly chart is plotted with two Standard Deviation channels. The mid-line is linear regression and the channels are plotted two SDs away from the linear regression. The blue represents the intermediate trend and the red is the primary trend.  In other words: if the dollar doesn't bounce up here, it may be on its way to 65 on the Dollar Index (DXY). But there are technical reasons to suspect it may bounce up. Then the question becomes--will the rise be sustainable, or just another station on the long road to oblivion? Why should we care? Here's why: everything tradable becomes more expensive as the dollar loses value. For visual proof, go to The Big Picture blog and scroll down to the CRB Spot Price Index chart posted on 11/5/07. It shows strong price increases in commodities starting with the "cheap money" policy of 2002. As Randall Forsyth noted in his Up and Down Wall Street column of 11/1/07, (The current stock market rally) is a paper rally; the nominal rise in stock prices is roughly equal to the decline in the dollar's purchasing power. For instance, the Standard & Poor's 500 is up over 11% in the past 12 months, but a European investor is losing ground as the euro is up over 14% against the dollar.Here's why we should care about the dollar's decline: it's impoverishing us by reducing our purchasing power and driving the cost of tradable commodities ever higher:  Yesterday I recommended the book Fiasco: The Inside Story of a Wall Street Trader Thank you, Harun and Cheryl, for helping us understand the financial risks we all face. Thank you, Reed H., ($20) for your third generous donation to this humble site. I am greatly honored by your support and readership. All contributors are listed below in acknowledgement of my gratitude. For more on this subject and a wide array of other topics, please visit my weblog. copyright © 2007 Charles Hugh Smith. All rights reserved in all media. I would be honored if you linked this wEssay to your site, or printed a copy for your own use. |

||

| weblog/wEssays | home |